nanny tax calculator canada

Here are the top tax deductions for real estate agents in 2022. It Could Work Out When You File Your Tax Return.

Nannytax Nannytaxcanada Twitter

Still this Baby Costs Calculator can help you get a sense of how much youre likely to spend during your babys first year.

. Compare other software. Track expenses. Wealthsimple also offers one of the best savings account rates in Canada and a brokerage service that is 100 free.

Self-Employed defined as a return with a Schedule CC-EZ tax form. Pay a nanny gardener or housekeeper. Turn your laptop into a nanny cam Need to keep an eye on something in your house while youre away.

Search and apply for the latest Travel nurse per diem jobs in Augusta GA. Download and install the software Windows only. Use the Arrive cost of living calculator to plan your finances and be prepared.

A sugary drink tax soda tax or sweetened beverage tax SBT is a tax or surcharge food-related fiscal policy designed to reduce consumption of sweetened beveragesDrinks covered under a soda tax often include carbonated soft drinks sports drinks and energy drinks. With our tool. American family in St.

We designed this easy-to-use Uber driver tax calculator. How to estimate your quarterly taxes. Change the amounts and selections below to get a customized estimate.

DogVacay is a network of more than 20000 pet sitters across the US and Canada who offer in-home dog-sitting grooming. Pencils paper clips a paper shredder and a calculator. Thomas Virgin Islands offering an Au Pair and Granny Au Pair job for Select Start Jun 2022 - Sep 2022 Select Children 2 Children 0 - 1 year old 1 - 5 years old Salary 850 USD per month.

The burden is on you to pay estimated taxes four times a year April 15 June 15 September 15 and January 15 of the following year to cover your anticipated tax bill. Competitive salaryFull-time temporary and part-time jobsJob email alerts. Canada English Canada French France.

Americas 1 tax preparation provider. 1 online tax filing solution for self-employed. All you need is an internet connected laptop with a built in webcam and some free software called Yawcam www.

Free fast and easy way find a job of 864000 postings in Augusta GA and other big cities in USA. Two studio apartments accessed from the 1st level entry are perfect for a live-in nanny or a grown child who hasnt quite left the nest--or with a few doors opened those studios become additional suites within the home. 1 Products and services may be offered by Royal Bank of Canada or by a separate corporate entity affiliated with Royal Bank of Canada including but not limited to Royal Mutual Funds Inc RBC Direct Investing Inc.

Our Uber taxes calculator is a free and efficient way to estimate your Uber or Lyft driver taxes by week month quarter or year. QuickBooks Self-Employed can easily calculate your quarterly estimated taxes based on your information and you can also e-file your quarterly tax payments. A 2-bedroom apartment with separate entrance and separate garage can connect to the main unit or give full privacy to its guests.

For families with children the federal government offers a grant called the Canada Child Benefit CCB. Its really easy to turn your laptop into a surveillance camera. Francesca notified her accountant she wanted to deduct 1100 for her home office 500600.

Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in Cornwall NY at tax lien auctions or online distressed asset sales. Interest calculator car loan. Interest-free or low-interest loans.

When it comes to working in peoples homes the working arrangements are often casual and wages are paid out in cash. A tax consultants business could benefit from the expected and considerable upturn in tax-related searches at certain times during the year and provide keyword-optimized tax advice see the Google Trends screenshot below for the phrase tax help. If you are not able to adjust your quarterly tax estimates the good news is that you can sort it all out when you file your annual tax return.

Get the latest headlines on Wall Street and international economies money news personal finance the stock market indexes including Dow Jones NASDAQ and more. Get the latest Soccer football results fixtures and exclusive video highlights from Yahoo Sports including live scores match stats and team news. Wealthsimple is Canadas most popular robo-advisor.

The answer depends on a lot of factors including where you live whether youll pay for childcare and which baby products you choose. These expenses could be for lodging meals tips taxi and other ground transportation fees. Based upon IRS Sole Proprietor data as of 2020 tax year 2019.

Be informed and get ahead with. The Tax Foundation is the nations leading independent tax policy nonprofit. DogVacay is a network of more than 20000 pet sitters across the US and Canada who offer in-home dog-sitting grooming boarding and.

Tax-Free Savings Account TFSA Flat-rate allowance for automobiles and motor vehicles. MemberCanadian Investor Protection Fund RBC InvestEase Inc RBC Global Asset Management Inc Royal Trust Company or The Royal Trust Corporation of. 075 lower than the maximum sales tax in NYThe 8125 sales tax rate in Cornwall consists of 4 New York state sales tax.

You pay federal income taxes on a pay-as-you-go basis. This grant provides a tax-free monthly payment to all eligible families living in Canada to assist with the cost of raising children under age 18. This policy intervention is an effort to decrease obesity and the health impacts related to being overweight.

As the leader in tax preparation more federal returns are prepared with TurboTax than any other tax preparation provider. Registered retirement savings plans RRSP Security options. Underpaying your taxes triggers a penalty while overpayment is the equivalent of giving the.

This grey area can lead to confusion for both parties but determining if a nanny or home-care giver is considered a household employee can make tax filing simpler for everyone involved. It offers investments in all kinds of accounts RRSP TFSA RESP RRIF non-registered accounts and has a roundup feature that can help you saveinvest your spare change. Since 1937 our principled research insightful analysis and engaged experts have informed smarter tax policy at the federal state and global levels.

Cornwall NY currently has 11 tax liens available as of August 26.

Nannytax Nannytaxcanada Twitter

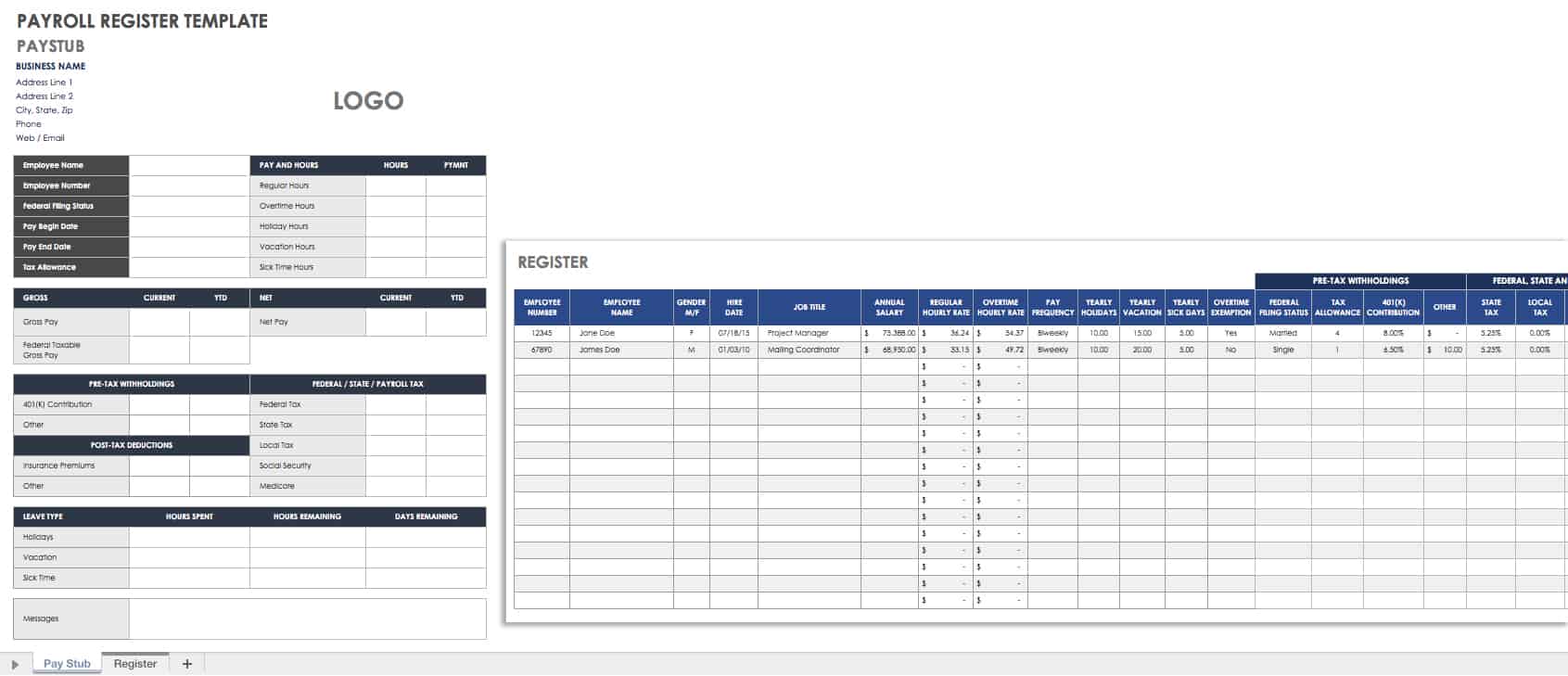

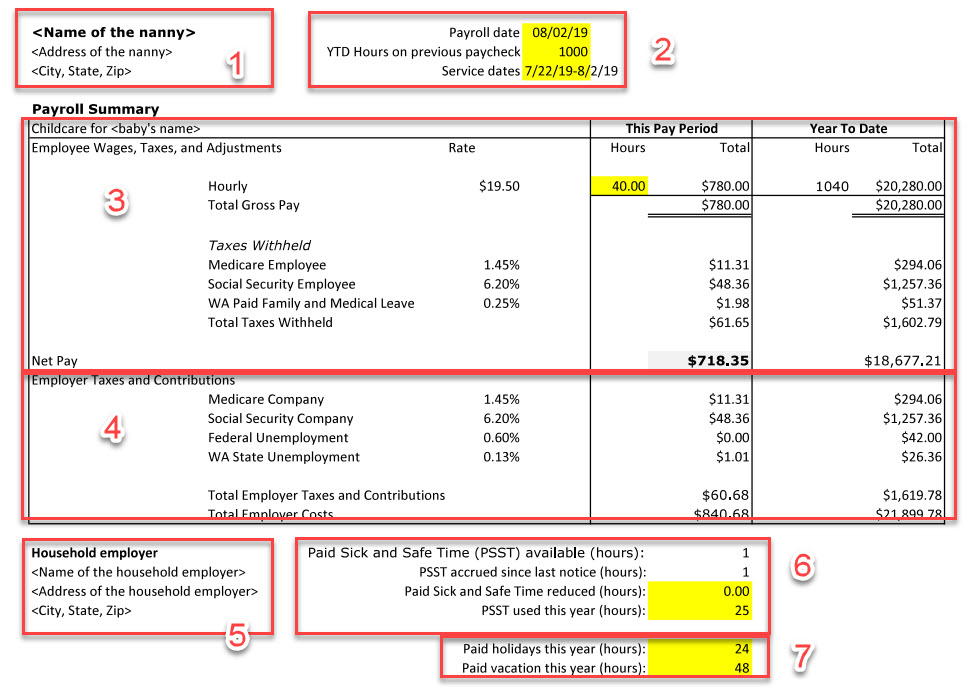

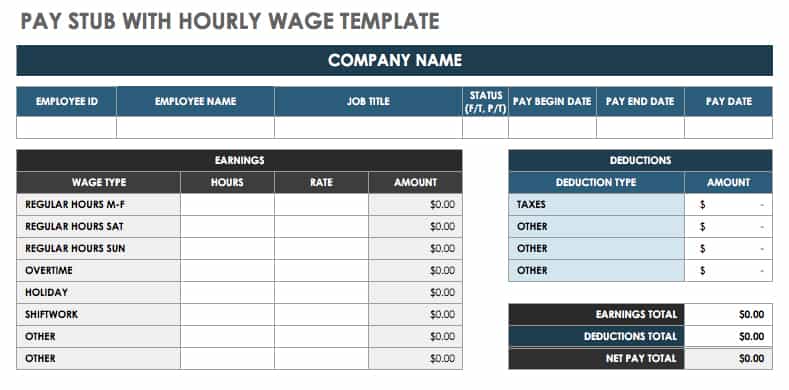

Free Pay Stub Templates Smartsheet

Nannytax Nannytaxcanada Twitter

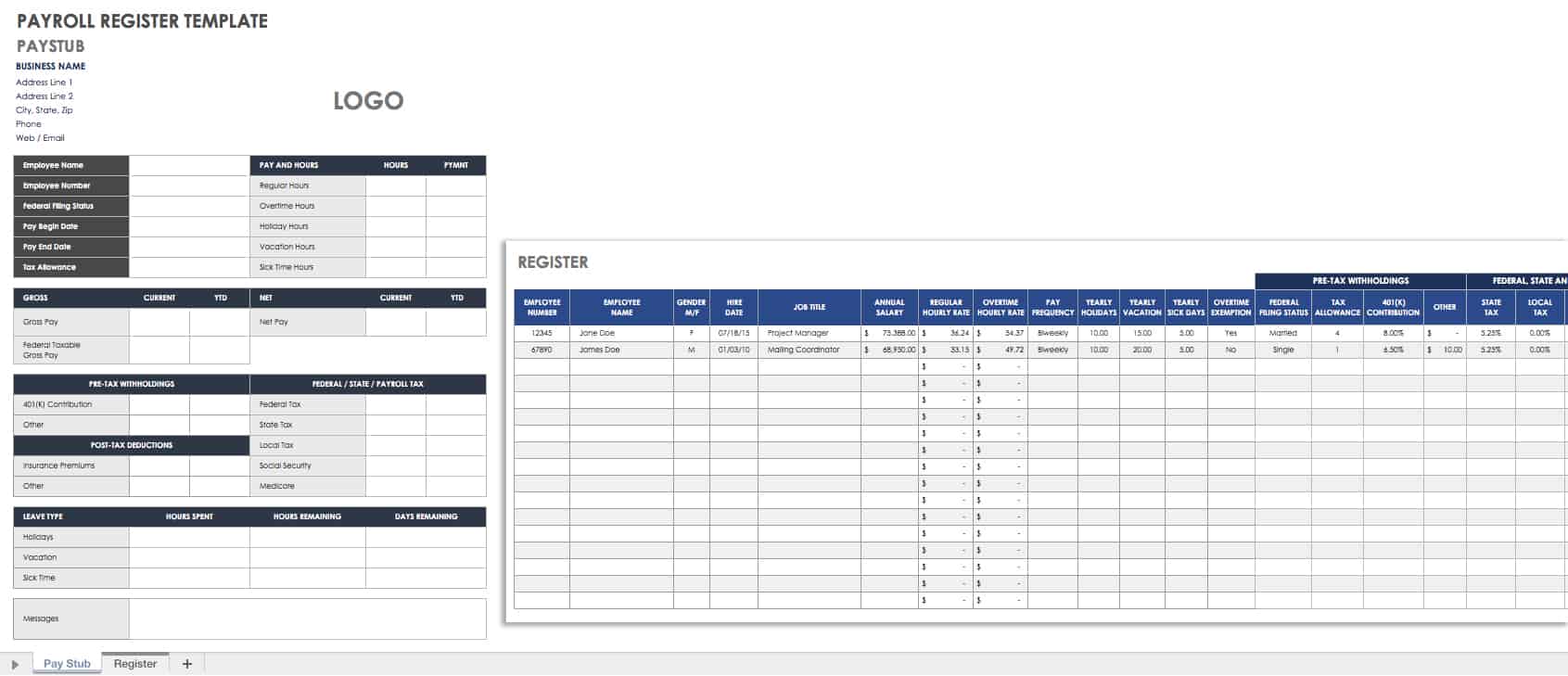

25 Great Pay Stub Paycheck Stub Templates

Nannytax Nannytaxcanada Twitter

Family Tax Deductions What Can I Claim 2022 Turbotax Canada Tips

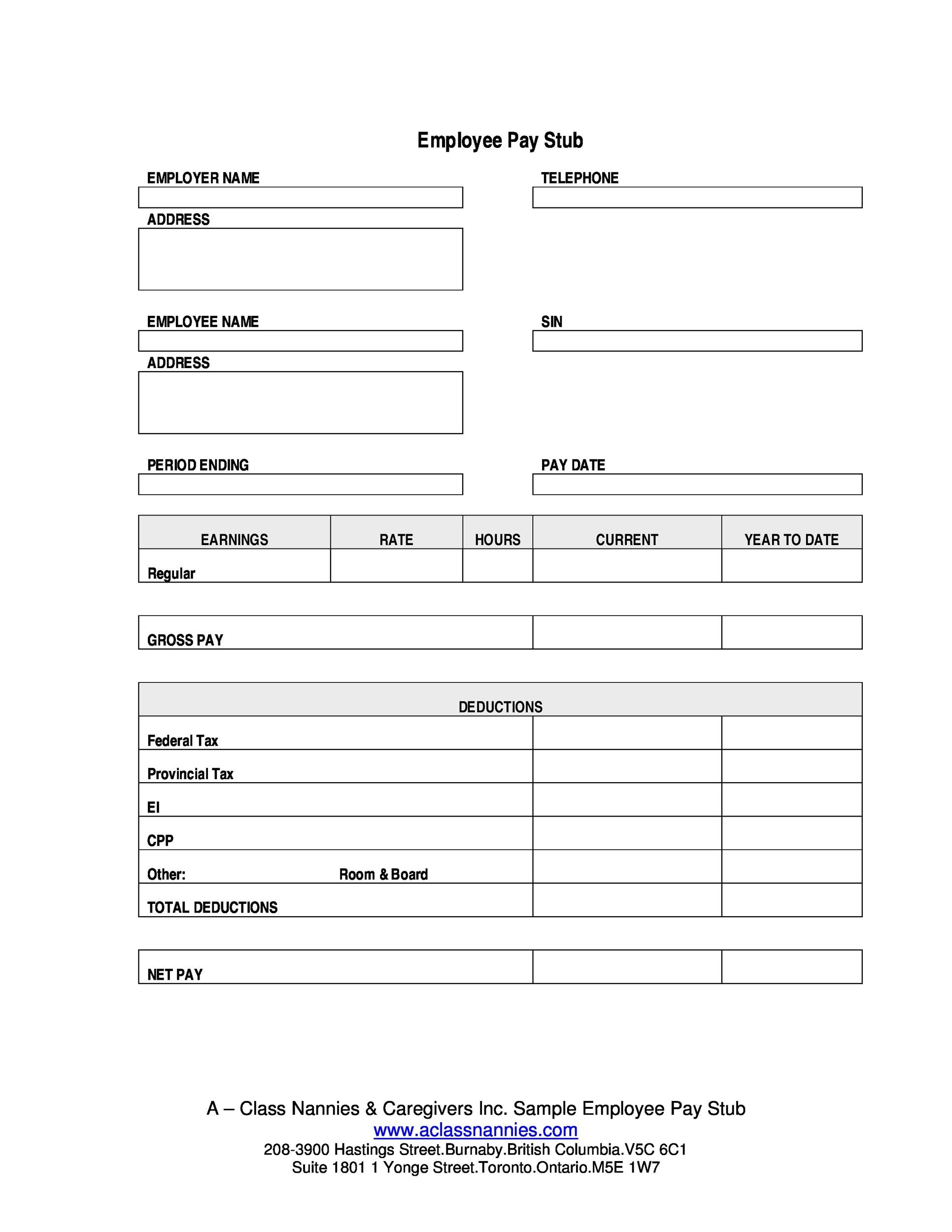

How To Pay Your Nanny S Taxes Yourself Nanny Tax Nanny Payroll Payroll Template

How Much Taxes Do Indians Working In Toronto Canada Have To Pay On Their Salary Quora

Prepare Free Nanny Payroll With Our Excel Template Nanny Self Help

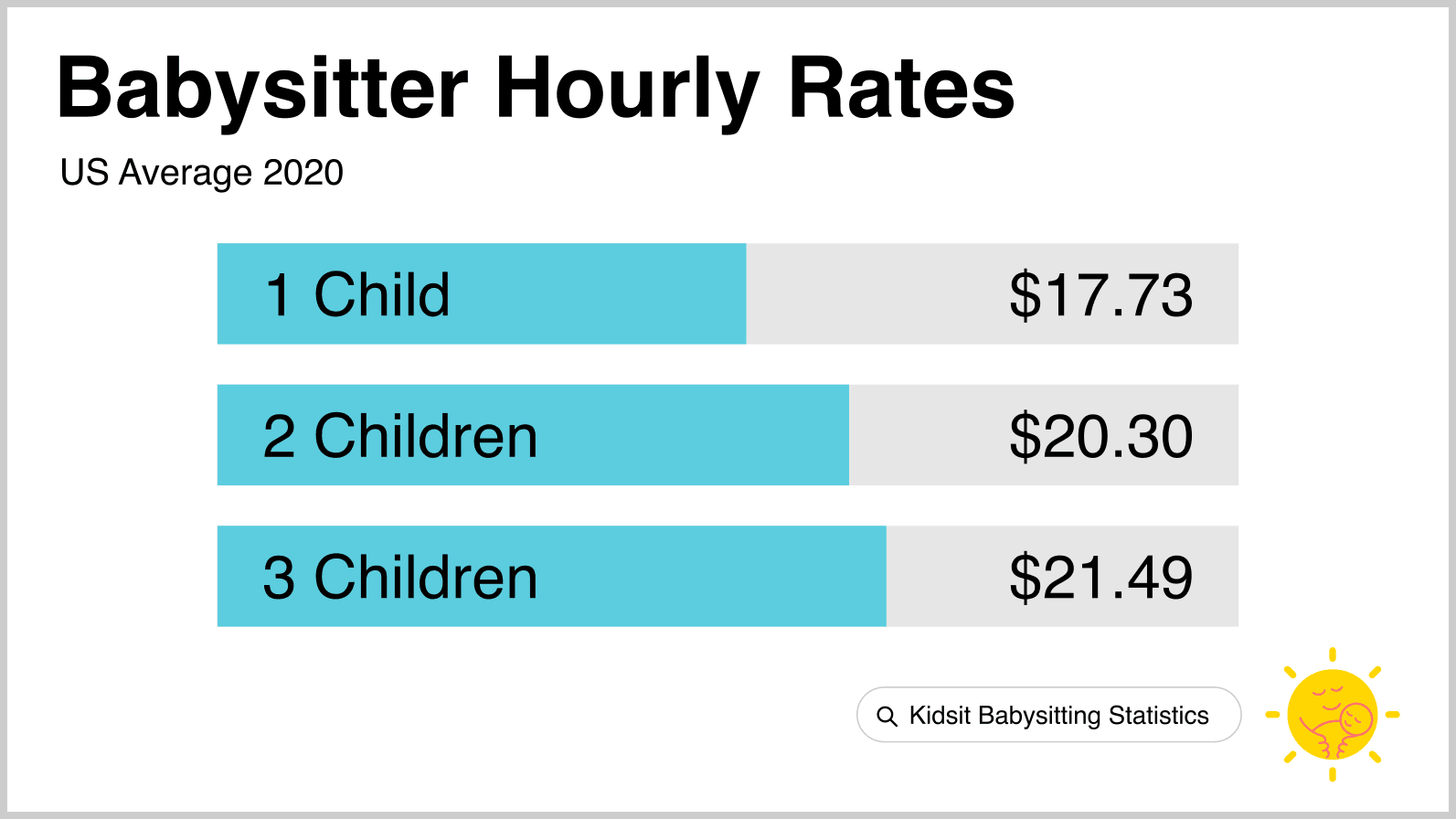

Babysitting Pay Rates How Much Should You Charge

Nanny Payroll Tax Services Canadiannanny Ca

Free Pay Stub Templates Smartsheet

Hiring A Nanny How To Legally Pay A Nanny In Canada The Nanny Solution

Calculate Your Net Income Manitoba Give Tax Rates Pensions Contributions And More Net Income Income Tax Income